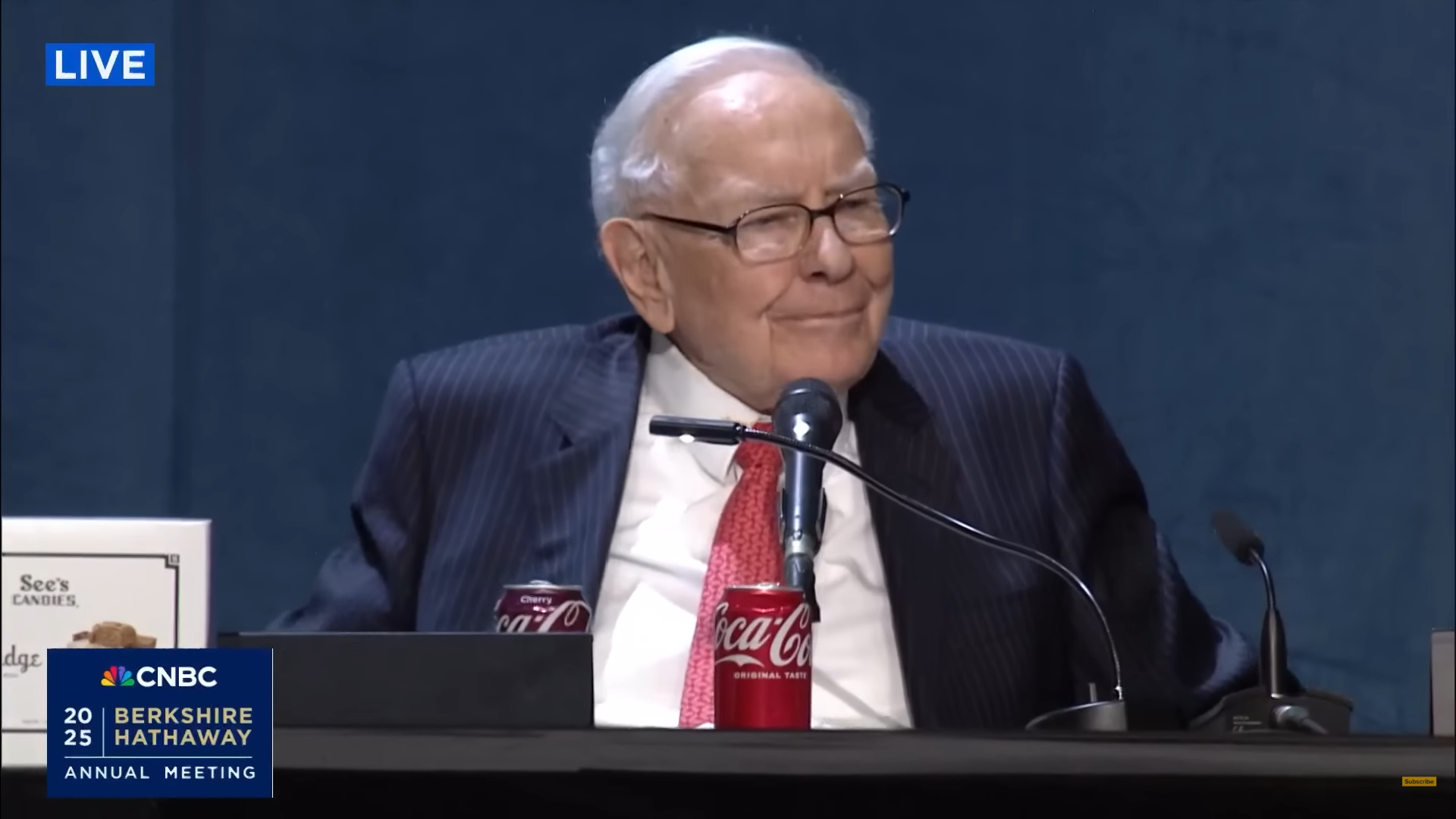

Image 1. Warren Buffett, at 94 years

Image 1. Warren Buffett, at 94 years

Introduction:

Warren opened by noting that this marks his 60th annual meeting - he believes it might be the biggest and best one yet. He shared a few records from the day before: attendance was up by 3,200 people compared to last year, and many of the on-site retailers reported record sales.

He then introduced all the directors, giving a special shoutout to Ron, who has served on the board for 28 years.

Warren mentioned that the only quarterly earnings call he listens to is Tim Cook’s Apple call. He joked that he’s a bit embarrassed Apple has made more money for Berkshire than he has. He praised Steve Jobs for choosing Tim as his successor, saying that Tim has led the company in the right direction.

Special mention about Melissa Shapiro, who helped organize this year’s event.

About 65 years ago, Warren met someone whose wife had nine children. One of his granddaughters is Carrie Sova. Carrie’s grandfather, Bill Kizer, ran an insurance company. Her father owned a company called Central States, which Berkshire eventually acquired. Carrie’s sister left the company after having four children, but Carrie stayed on and showed great talent.

Warren later asked her to put together a book for Berkshire’s 50th anniversary. She eventually got married, had three children, and left the company. Still, they stayed in touch - Warren now invites her to an annual baseball game. For the 60th anniversary, he asked her to create another book. As of yesterday, they had sold 4,400 out of the 8,000 printed. Some of the proceeds go to a local Omaha charity.

Carrie gathered a lot of material - including contributions from the Munger family - but didn’t accept any payment for her work. Warren joked that he’ll be asking her to do more in the years to come.

On trade barriers, import certificates and tariffs:

The goal of import certificates is to balance imports and exports. They were designed to promote balanced trade, based on the idea that balanced trade benefits the world. Historically, the U.S. transitioned from an agricultural economy to an industrial one - but trade deficits have continued to grow.

Warren noted that trade can sometimes resemble acts of war and has, at times, led to negative consequences. He believes the U.S. should aim to trade more, focusing on what it does best, while other countries do the same. In the early days, the U.S. excelled at producing tobacco and cotton. The goal, he emphasized, should be a prosperous world - not a scenario where a few countries succeed while others are left behind and grow resentful.

Buffett’s idea of using import certificates didn’t gain much traction, but he mentioned he can provide a copy of the proposal for those interested. While the U.S. has been a remarkable success story, he pointed out that it’s not ideal if 300 million Americans are thriving while 7.5 billion others are not. He believes America will ultimately be better off in a world where everyone prospers.

On Japan, rising rates, and whether higher rates would affect investments there:

Warren said he applies the same investment principles in Japan as he does elsewhere. Japan has been an incredible story. He recalled going through a Japanese company handbook years ago and finding a few standout opportunities that looked better than what was available elsewhere.

Looking ahead, he hopes Greg Abel will be running things for the next 50 years. Companies like Apple, American Express, and Coca-Cola all perform exceptionally well in Japan, and the five Japanese trading companies Berkshire has invested in have treated them extremely well. Greg meets with those companies a couple of times a year, and they think they will hold those investments for decades.

Warren added that these five trading companies operate globally and do so very effectively - and he has no intention of asking them to change how they run their businesses.

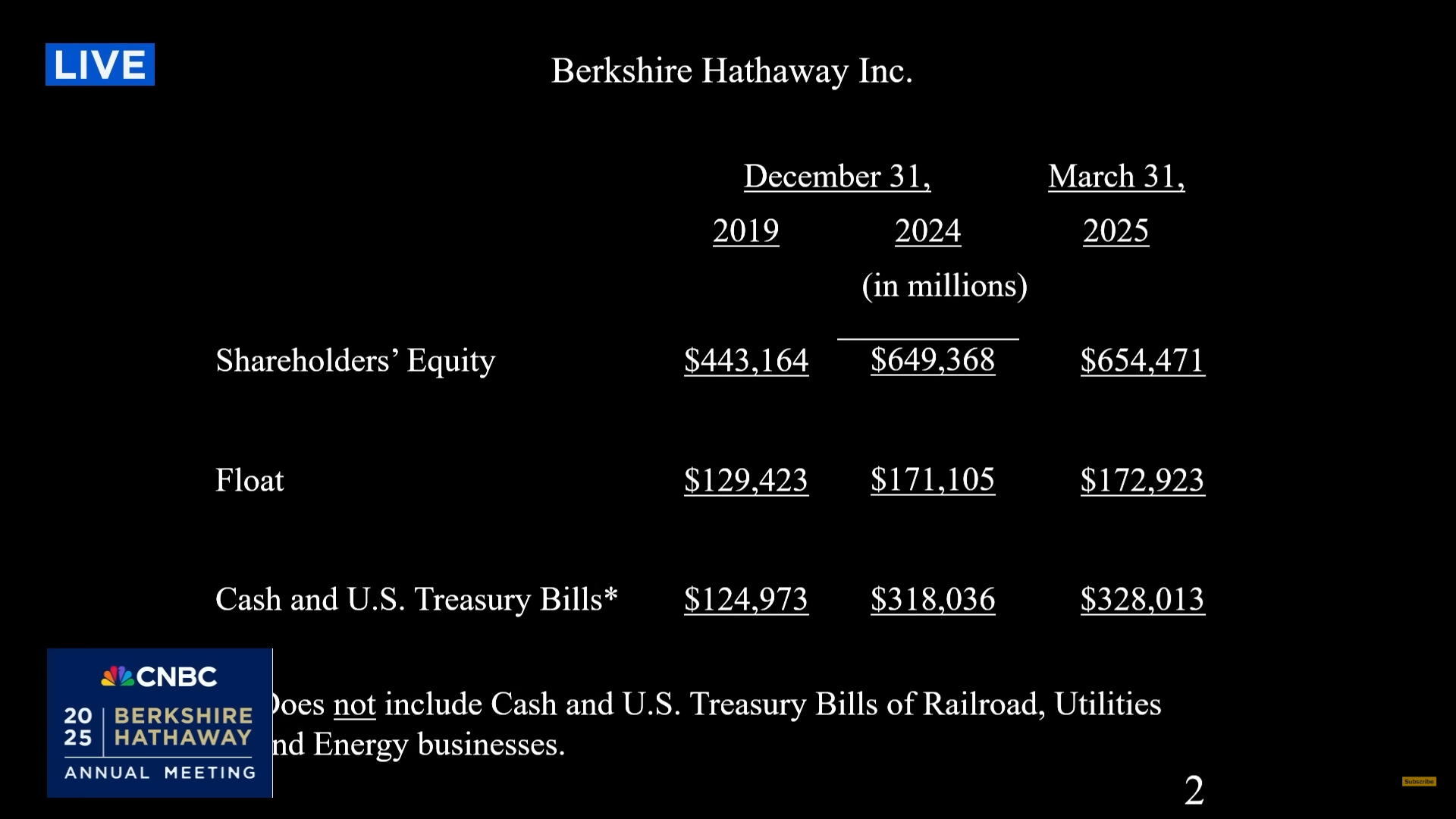

On the $300B cash pile and whether he’s holding back investments for Greg:

Warren made it clear that he’s not withholding investment opportunities to leave extra cash for Greg. He joked, “I wouldn’t do anything like that.” They came close to spending $10 billion recently and he wouldn’t hesitate to spend $100 billion if the opportunity made sense.

Over the course of 80 years, Buffett has had about 16,000 trading days, but he doesn’t aim to make trades every day - that’s not how he invests. Berkshire has made a lot of money by not being fully invested at all times. No one truly knows what the market will do next, and people often speculate just because it's easy to talk about.

He described reading through Japanese company handbooks as a kind of treasure hunt. And when they finally do find the right opportunity, he said they’ll be glad to have the cash ready.

On real estate and if value investing is still strong:

When it comes to real estate, Warren explained that the involvement of multiple parties in deals can make it difficult. While there have been good deals in the past, he believes stocks are generally easier to invest in. Charlie Munger did some real estate investing in the later stages of his life, but he noted that he wouldn’t have done it when he was 21.

In real estate, once you make a deal, the next stage involves more negotiations, and it can take a long time to complete. Sometimes, negotiations drag on for years, and it requires a certain type of person who enjoys that process. Berkshire did some real estate investing in 2009, but Warren said that they’re better off focusing on investing in securities.

On AI and insurance:

Ajit Jain: There’s no question that AI will be a game changer. It changes the way they assess risks and pay claims. People chase the best thing. They don’t want to be the first mover - but they will wait and see before they throw more money into it.

Warren says he wouldn’t trade any AI development in the next 10 years for Ajit Jain.

On acquiring a Chicago Hot Dogs company (Portillo’s) and how it’s a fit in the portfolio:

Warren thinks it might be a subsidiary of a subsidiary. But neither Warren nor Greg know anything about this.

Warren says he looks at the financial statements of 50 or 60 Berkshire companies every month. Marmon himself owns about a hundred companies - and it is highly diversified. There are various branches of the Pritzker family.

In 1954, the US federal tax code went through a big change. There was a company called Rockwood Chocolates in Brooklyn - they sold that at the grocery store. Cocoa was 5c/pound when it was first sold. There was a provision in the new tax code that if you owned two companies and if you owned one of them for 5 years and a few other rules, you’d have no capital gains. The wholesale price and price of the end product didn’t match so Rockwood got out of that business. In the end, Jay Pritzker bought that company. Buffett was 24 or so. They wanted to figure out how not to pay capital gains on the sale. No one else showed up and there was a lot of cocoa there. Jay gave Warren a lecture - he could have gone to grad school and never learned as much as he learned through that lecture.

This became the basis for Marmon. He developed the car that won the first Indianapolis race - invented the rear-view mirror.

Greg got a message on stage from Peter (maybe an executive at Berkshire) - Berkshire Capital Partners owns that company and it’s not associated with Berkshire Hathaway. So, Portillo’s is not a company in Berkshire Hathaway’s portfolio. Berkshire Capital Partners is in no way affiliated with Berkshire Hathaway.

Buffett joked, "This is just a sample of how we operate here."

On American resilience - is there a fundamental change:

Buffett said the USA started out as an agricultural economy. Then there was a constitution that said everyone is equal. Later came women’s rights, and there have been many changes throughout history. The US has changed since he was born, in the 1930s. There were recessions, atomic bombs, and so on. So, he wouldn’t get discouraged by every problem that comes along. If he were born today, he would rather be born in the USA.

On whether acting fast benefitted him ever:

Buffett said sometimes acting fast is good. In 1966, he got a call from Fel Steiner in New York. He represented the Annenbergs. He wanted to sell a business to Warren. Warren talked to Charlie and found it interesting. They went to New York to talk about it. He was offered to buy a business at a bargain. The business was making a million a year pre-tax, and the price was 6 million. It had 2 million in cash, 2 million in real estate and a key block of Philadelphia Market Street. It was making 2 million a year pretax. The seller wasn’t enjoying running the business with his partner’s widow. He said he would run the business until the end of December and then quit. But Warren was sure he wouldn’t, and they’ve had a wonderful relationship since. This was one scenario where they acted fast. This was one scenario where people from New York had a stereotype about what people from the Midwest were like, assuming anyone from there was okay. He said his work is a combination of patience and willingness to do something that afternoon if it comes to you. You also don’t want to be too patient about people talking about things that will never happen.

Greg said they are ready to act. That’s an important part of being patient.

Buffett added that you have to be willing to hang up after 5 seconds or be willing to say yes after 5 seconds. You can’t have self-doubt. The good thing about this business is that people trust you. He said, “Why work at 90 when you have got more money than anyone can count?” Buffett and Munger enjoyed that people trusted them. They never sought out professional institutions to handle them - he just liked good people.

On Geico modernizing:

Ajit Jain said Todd Combs had done a great job turning around operations. There were two main issues - matching rate to risk, and telematics. Since introducing telematics, they had made rapid strides. Geico was now as good as any other competitor. In terms of matching rate to risk, they had caught up and were now on par with others.

Todd reduced the workforce from 50,000 to 20,000, which translated to $2B in annual savings. This led to a combined ratio with an 8 in front of it - it was low. But the job wasn’t done yet. Ajit said they needed to be prepared for AI, for example.

Warren said each business Berkshire owns was different - everything has different opportunities. He paid $50M for half of Geico. This quarter, Geico made $1B. The auto-insurance policy didn’t even exist 120 years ago. Geico now provided $29B in float and earned $1 Billion in profit a quarter. We've been selling the same product since 1936, however, he said they were becoming more sophisticated in operations. Leo Goodwin left USAA to start Geico. Since then, Geico has been a fascinating story.

Warren said nobody liked to pay for insurance, but people liked to drive. Lorimer Davidson was the only person in the building that Saturday when Buffett visited Geico. Buffett initially asked if there was anyone else he could talk to, and Davidson said no. But that meeting changed Buffett’s life dramatically. Buffett said if you have a handful of those moments, you’ll do well. This fell under the category of “turn every page.” He said you need luck in life.

On Greg Abel and why he’s a good successor:

A main part of investing is about finding what’s wrong in things - he always thinks about what the missing piece is. There were people in the Berkshire Hathaway exhibit (the vendors in this meeting venue) who work hard and they enjoy what they do. Buffett has had 5 bosses and he’s enjoyed being with all of them. If you like to work somewhere, that’s the place to go. There’s a movie called The Glenn Miller Story - he created the first gold record - he went from nothing to create the right sound - then created the first gold record. If you get lucky like I did, you’ll find what you like when you’re young. Don’t worry too much about starting salaries and be careful about who you work for because there are habits you’ll take from them. It’s the greatest country in the world and it’s the greatest time in the world.

There was a book called “You Only Have to Get Rich Once”. If stupid things are happening around you, you don’t want to participate. If people are participating in securities that are junk, you just have to forget that as that will bite you back at some point. Warren enjoys his “wonderful life” at the present time.

Greg Abel says he’s grateful and humbled to be here. He fell in love with his job and he thanks Warren Buffett.

Warren says if you don’t find your passion when you are young - you’ll find it eventually. It’s like marrying - some of you marry the first person you meet - sometimes it pays to wait as well.

On US dollar’s currency risk:

Buffett said they had invested in local currency in other geographies - for example, in Japan. That was not a formal policy, but they had done it in the past. On the question about impact on earnings, he said they had never done anything based on targeting earnings. There has never been a case of “if we do this, our earnings will be this…” If you started focusing on what number you had to produce, you could get tempted to play around with the numbers - and sometimes seriously play around. Some people regarded playing around with numbers as okay, but not Berkshire.

Regarding the Japanese Yen, he said there were some GAAP charges, but it didn’t make a difference in the long run. Obviously, they didn’t want to own a currency that would crash significantly. That was his concern with the US Dollar. He mentioned in the annual report that fiscal policy was what scared him at the moment. This concern was not limited to the USA - in some places things could get out of control. Governments needed to have checks and balances to ensure there weren’t serious fiscal risks. The value of a currency was a scary thing, and they didn’t have any strategies for beating that. In the case of the Japanese Yen, maybe they did. But Japanese-denominated liabilities were not something they worried about in the long term.

Greg said they were happy with the Japanese investments, and it was an added opportunity to pay for them in Japanese Yen.

Buffett said Charlie always felt that if he had to pick an area outside of stocks, he could have made a lot of money in foreign currency. He added that if they made a large investment in Europe, for example, they might consider financing it in the local currency.

On any advice to Mongolia to attract investors like Buffett:

Buffett joked that he had trouble planning trips even a few blocks away. He said he met someone who did well in Mongolia and even moved there for a while. His advice would be that the government should develop a reputation for having a solid currency over time. He didn’t want to be in any country that had runaway inflation. That was an important factor for them. He also wasn’t sure if there were size requirements that would fit Berkshire. But if the country developed a reputation for being business-friendly and currency-conscious, it would bode well for residents and for external investors too.

He asked who would have bet on the US in 1780, for example. But the country just had to be a little better than others. Now it’s 25% of the world’s GDP and all sorts of good things. He said he wished Mongolia well.

On large private investment firms being in insurance and competing with Berkshire:

Ajit Jain: There’s no question they have come and we’re not competitive. There are two segments - property casualty and life insurance. The private equity companies are involved in the life insurance segment. When credit spreads are low, private equity firms have invested assets where they get a lot more return on investments. If the economy is good, because of leverage, they make money. But regulators could say you’re taking a lot of risk and that could not end well for them. So, Berkshire doesn’t compete in that segment at the moment and they haven’t done any deal in that space.

Warren says this is capitalism and those private equity companies have a different system. Sometimes it works and sometimes it doesn’t. If it doesn’t, they move on to other things, but at Berkshire they have to live with it. There’s no other property casualty business that can replicate what Berkshire can do now and Ajit Jain built that business since 1986 - when others had given up.

On advice to young investors:

Who you associate with is enormously important. Your life will progress in the general direction of who you work with, who your friends are etc. He mentioned a few names before about his associations, which has benefitted him. You want to hang out with people who are better than you are. It’s harder to understand that until you’re much older. Tom Murphy, Sandy Gottesman, Walter Scott for example. If you have people like that you’ll have a better life than finding someone who just makes a lot of money. So, if I were younger, I’d associate myself with smarter people. When you find them you treasure them. You’ll find people do wonderful things for you.

He mentioned earlier about going into the Geico building on a Saturday. The man there was wonderfully helpful to Warren and you want to be helpful to others as well. If you are helpful to them in return, you get a compounding of good intentions. I was lucky to have a good environment. Don’t feel guilty about your good luck. If you live in the US, you have already won the game to a great degree and just make the most of it. You don’t want to associate with people or enterprises that tell you to do things you shouldn’t be doing. So many people get out of the insurance business after you’ve made a pile of money. But you want to be enjoying what you do.

The best manager Warren knew was Tom Murphy Sr. He hasn’t seen anyone who could extract potential out of someone like Tom Murphy Sr. could.

To operate from Sandy Gottesman and Walter Scott Jr. (Greg Abel worked with him for about 30 years), has been incredible. That’s his recommendation, and for some reason you live longer too when you do that. All of the people he talked about have lived a long life and he attributes this as one aspect of it. Happy people live longer.

On market volatility and the recent $10B investment:

Warren says he can’t talk about the recent investment. In the last 100 days, there’s been volatility - but it’s nothing. Three times in history, Berkshire has fallen by 50%. Dow Jones dropped from the equivalent of 100 to 11 once. Markets have dropped a lot in the past. So this volatility is nothing. The world will not adapt to you - you’d have to adapt to the world.

On major setbacks or low points of Warren’s life:

Some people handle it well and some people don’t. Warren jokes that it’s a major setback when you die.

He thinks you’re less likely to have setbacks from medical problems because of the advances in medicine in our times. Everything in our life is now so much better. But bad things do happen. It can often be a wonderful time, but there could be terrible breaks in it. So far, it hasn’t happened for him but it can happen. For 94 years, I’ve been able to drink (lifts his Coca Cola can up) what he wants and his health has kept up.

For example, look at the lifespan of professional athletes - you’d be better off if you weren’t chosen to play. Warren never exercised - he jokes he was carefully preserving himself to live longer.

On autonomous vehicles and disruption risks:

Ajit Jain: Most car insurance revolves around operator errors and what premiums we have to charge. Self-driving cars are safer and have fewer accidents. Insurance will be less required. But instead, there’s product liability. So Geico will be readier to provide insurance on that instead.

Warren says they expect change in all their businesses. Charlie pushed him on it. The textile business investment, for example. If you win every time, things won’t be interesting. It’s part of the fun to solve problems. If you went back 100 years, who would have predicted people’s transportation as it is today?

There are now 8 nuclear countries and a ninth coming in soon. He doesn’t expect the right people to be in charge in all the countries. When Einstein came up with E=mc^2, he couldn’t have envisioned how this would change the world. In Warren’s lifetime, no one thought about how this changes warfare. Most famous letter in the world about Leo Szilard – got Einstein to sign it – Roosevelt understood Einstein signed it. They said this could destroy the world. And Heisenberg was in Germany. Anyway, things change. He asks why North Korea needs nuclear weapons? Anyway, there have been many changes in the world, but humans haven’t changed much as a race.

Warren thinks this would be an easier problem for us to solve than transitioning into a conglomerate from being a textile business in New England. So far, they have done quite well in insurance.

Ajit wants to add that he mentioned product liability. In addition to that shift, there will be a major shift – the number of accidents will drop dramatically. At the same time, the cost of repairing will go up significantly because of technology in the car. So how those variables interact in terms of overall costs is still an open issue.

Warren says when he walked into Geico’s office in 1950, the average price of a policy was $40/year. The number of people killed in accidents has gone down 6 times and cars have gotten much safer. There’s the Buck Rogers effect to it. Homeowners insurance in Nebraska has doubled in 10 years, adjusted for inflation. It’s hard to predict what will happen. You can’t get an answer just by reading one report because there are fifty other things going on. Results are not as predictable.

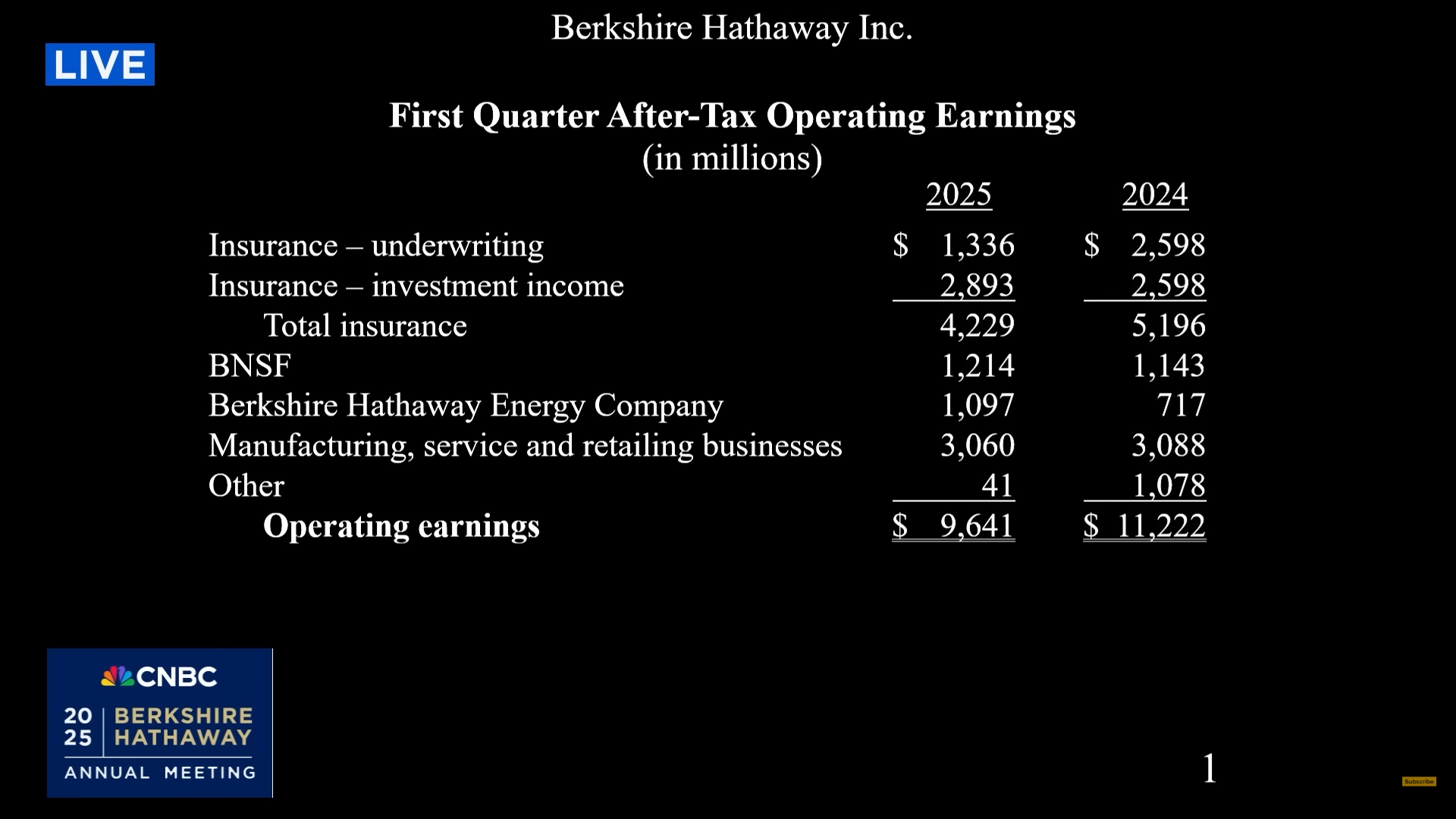

On operating earnings:

Warren says they released the 10-Q this morning.

We do have unusual advantages in the insurance business. Our investment income did not change that much. The railroad hasn’t earned as much, but it’s a solvable issue. It’s still a great asset. The energy business had issues last year, but it doesn’t have issues this year.

Greg says that of the 49 businesses they measure, 28 were down last year.

Every now and then you have extraordinary opportunities, but most of the time you don’t have an edge. Our float continues to grow.

Ajit Jain: Our cost of float is -2.2%.

Warren says it’s like having cash and you have -2.2% to pay on it.

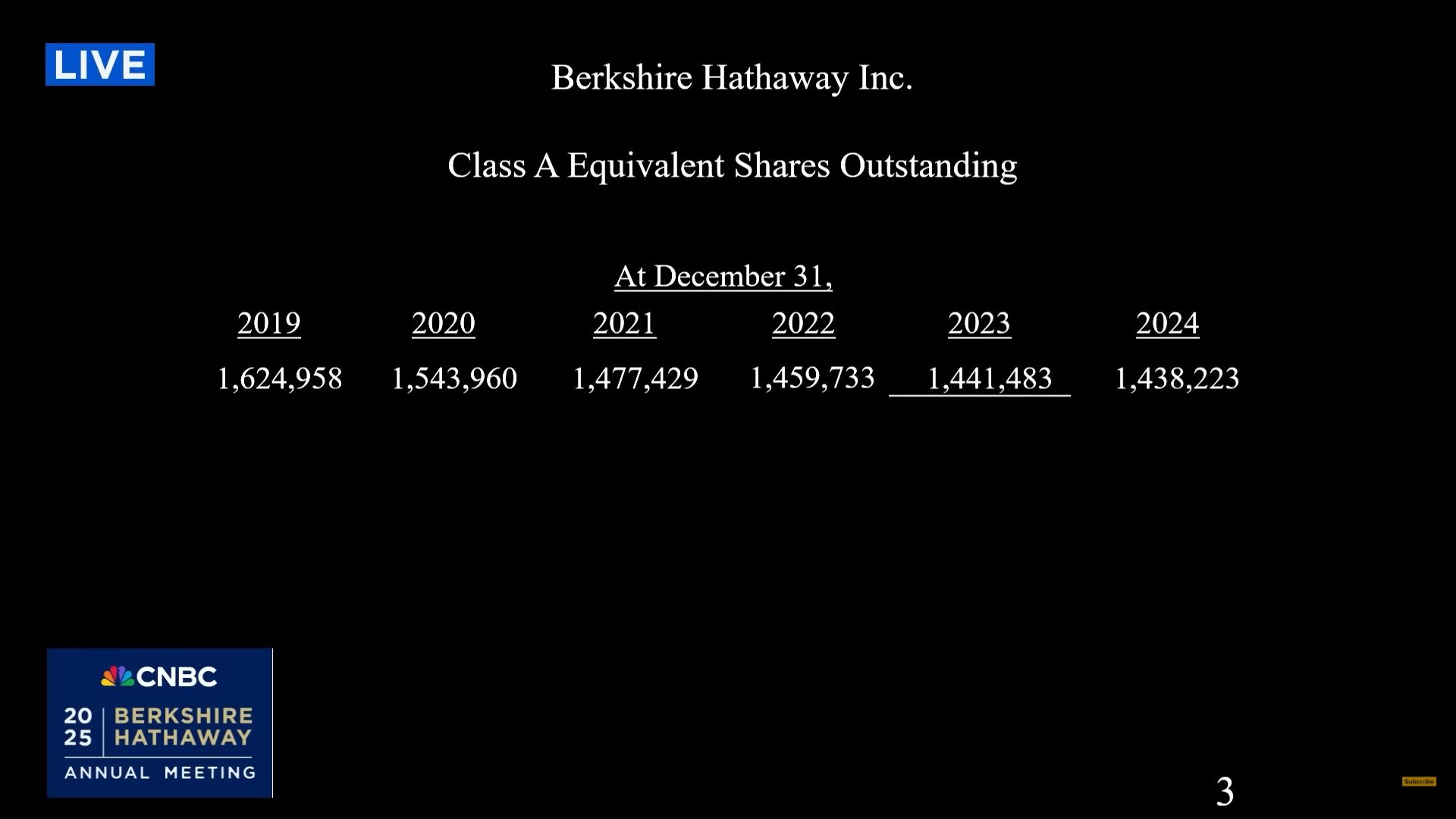

For share repurchases, there’s a new rule where you have to pay 1% as a company to buy back shares. Warren thinks it hurts them, and so he hasn’t done anything this year. But Tim Cook (in the audience) has done a wonderful job in share repurchases for Apple. So, repurchases are slightly less attractive than before. We’ll only buy if it’s almost certainly underpriced.

There was a 30 minute break.

Second session:

Warren starts off the second session by recommending a movie - “Becoming Katherine Graham” on Amazon Prime - which I (author of this blog) personally have already watched.

On what Greg learned from Warren and vice versa:

Warren says that the main thing he wants to be known for is “old age.”

Greg says that he wants to be remembered as a great father and a coach. He thinks of Warren as a teacher – they talk each day about opportunities. He talks about his first meeting with Warren. Warren was buying the MidAmerican energy business at that time. He went there on a Saturday morning and Warren had the financial statements with him. He locked in immediately on the derivatives contracts. They did have them and it’s usually part of utility businesses. Warren wanted to go into the constituents and the underlying risks. Warren also talked about the energy crisis. A couple of years later, Warren asked how much money they were making in the crisis. The answer was not much more than 6 months ago because the derivatives were not speculative.

Warren says he spends more time on balance sheets than income statements. He looks at them for an 8 or 10-year period. It’s harder to manipulate a balance sheet. You still have to understand what it says, and there’s a lot to be learned about what a company wants to say, or not to say.

People don’t remember much about Katharine Graham, who had a major impact on the USA. Warren thinks you can learn a lot from history. Charlie always said: don’t take up a position unless you can argue their position better than they can. His dad was an incredible teacher too. And then he wanted to move on to the next question.

On Greg’s capital allocation skills in the next 10 years:

Greg: We’ve started from a great place. We have great values that have set us up. It’s equally about managing risks.

First value: We’ll maintain the Berkshire reputation. We’ll have a fortress of a balance sheet. We have a significant set of cash, which is a great asset. It’s a strategic asset that can be used to weather difficult times. We’ll not be dependent on a bank or anyone else to be successful. Capital allocation comes with understanding risks across Berkshire.

Second value: We have a great set of companies that produce a large cash flow. That’s a strength that will be enforced. We’ll start by looking at businesses – are they properly capitalized? They will operate autonomously, and Berkshire still manages the capital. Regarding stocks, we own a piece of that company. Do we have a good understanding of what that company will be doing 5 years from now or 10 years from now? That’s the investment philosophy – owning the whole company or a piece of a public company.

Warren said that the country needs redevelopment. For example, with interstate highways, it needs coordination with the whole country. During the World War, you needed coordination from all parts of the country. We have particular know-how in the energy transmission area that’s critical for the country, and we need to make sure it works for everyone. He likes government–private cooperation regarding the energy businesses – just like how highways were critical infrastructure.

Greg says Berkshire will be in a good position, and the risks around it would be different than what they are today.

Warren said government involvement would be important. If they had taken a vote on the Interstate Highway, it would have slowed down the project to an incredible extent. Warren said that we do have capital. Energy is not an easy problem. The country wasn’t designed for 48 different jurisdictions that can create new problems for every project.

On what teenagers can learn so she (teen questioner) can get hired by Berkshire:

Greg said that the questioner’s father was right – you need to work hard, have a good work ethic, and have the attitude that you want to contribute. If you like the things you do, you will go far.

Warren said, “Keep alive the curiosity and read a lot,” as Charlie said.

On future liabilities, say wildfires:

Warren said they’ve made a few mistakes in the past. When they bought PacifiCorp, they made a mistake by not carving it up into the seven states they were buying. It came as an aggregation, and they kept the same structure - that was a big mistake. Every part of the country needs electricity. There are parts where private companies are unable to operate well - we’ll wait and see how it gets handled.

Greg said that wildfire risks go up each year. We can’t eliminate that risk, but we can reduce it. The reality is that wildfires have happened in Texas. How we do it is by assessing our assets - making sure we’re not causing the fires - hardening the system - taking an operational focus. There have been unusual weather events. One thing we did was we didn’t de-energize systems as fire was approaching. We will reduce that risk in the future. Now we have realized we need to de-energize the systems, and we will do that. Greg says we may be the only company that does that.

Becky Quick asked a follow-up question on that — aren’t there other risks, say, a hospital gets shut down because of the power shutdown?

Greg said that’s a routine risk, that they work with hospitals on that regularly. It’s not just about solving the returns side, but also solving the risks side - working with regulators to find the right process.

Warren said there are some problems that can’t be solved. We shouldn’t take investors’ money and take on issues that we’ll not have solutions for. You can present your case all you want, but if you don’t hold the pen in the end, then it doesn’t work. We think about what a sensible solution is - the right solution regarding the interstates was not to have 48 different jurisdictions pass laws on it.

Greg said that we can’t become the insurer of last resort. Regarding the 2020 wildfires - we’ve asserted that it was a lightning fire in our service area. We didn’t initiate it, nor did we contribute to it. We’ll get through that litigation. We’ll have clearer definitions of liabilities.

Warren said that we’re not going to do things with investors’ money that can be considered stupid. But it’s important that the USA has an energy policy - like how during WWII we learned how to make ships extremely fast - with the power of the government. It’s not so clear when 330 million people are all arguing for their self-interest. That’s management, and we’ll do our best.

A Polish woman asks for time to meet:

Warren said that when he was very young, he’d drive around to various offbeat companies. The CEOs would see him because they weren’t getting calls like that. If you want 10 minutes of their time, take an hourglass with you - don’t stay after 10 minutes unless they ask you to stay.

Here’s a question he’d asked sometimes. If you were stuck on a desert island and you could only own one of your competitors’ stock, which one would it be? Every manager likes to talk about their competitors. He learned about various industries this way. He was also making sure he wouldn’t stay too long. Meanwhile, they would talk about their competitors, and Warren would just listen. Since then, investor relations has been departmentalized. All companies now have departments where they say the best thing you can do is buy our stock.

Warren said Berkshire has plenty of materials to read and that she doesn't need a personal interview. He admires her effort, but she’ll just have to settle for that for now.

Difference in Berkshire Hathaway Energy (BHE) value through two rounds of acquisition:

Warren said lots of things can change over time. He’s made plenty of decisions like that as he’s watched many companies over 70 years. Berkshire Hathaway Energy is worth a lot less now than 2 years ago because of societal problems. The public utility business is not that great to be in - for example, look at the Edison energy business in California wildfires. Our enthusiasm for buying public utility companies is quite a bit less than it was a few years ago. You need lots of money for it, and we’ll see where we go. But, we also have a responsibility to the shareholders of Berkshire Hathaway.

Estimates on Berkshire’s earning power:

Warren said that when we made the recent acquisition for $10B, that added to their earning power. It depends on markets, interest rates, and investor psychology. Over his lifetime, he’s had fabulous opportunities because humans are human. If Berkshire went down 50% next week, that wouldn’t bother Warren at all - but that’s not how most people are. In his brain, emotions don’t work the way they do for others. To answer the question, the earning power won’t come in an even stream, and it won’t be matched dollar for dollar on each side.

On Large Cap companies and if they are asset-light:

It’s better to make money without investing a lot of capital. For example, in the case of Coca-Cola, the finished product goes to the bottling companies, and that takes capital, but selling it doesn’t take a lot of capital. We have businesses that make high returns on capital. Property Casualty insurance is rare in that you could use float to purchase other businesses. That’s why we’ve done so well over the years. It’ll be interesting to see how the Mag7 perform now that they have to spend more capital to generate the same results.

In the money management business, people have become richer because others put up the capital, and you charge them for managing it. If all of you (shareholders in the room) paid 1% management fees, you’d have paid $8 billion. It’s about acquiring more money. That’s capitalism.

He saw it in operation when he worked for Salomon. Charlie and Warren decided it wasn’t an elegant business for them, and it didn’t appeal to them after a while. With Charlie and me, we put up our own money, and so we lost money too when everyone else lost money.

Warren asked Greg how it is in Canada. Greg said it’s very comparable in Canada.

Warren said it’s produced wonders in the USA. The Rockefellers and others - they put up money in businesses. Now the trick is to use other people’s money. You can’t blame them, but you should be aware of what their motivations are. What it is is a combination of this magnificent cathedral and a massive casino attached. But you have to make sure that the cathedral is fed too. People are promised the most money at the casino, but the balance between the two is important. In the next hundred years, the U.S. has to make sure the cathedral doesn’t get overrun by the casino. It’s hard to make the argument that people got what they deserved. If there’s a better method, we haven’t found it yet.

On what education or activity made Warren the greatest investor of all time:

The teachers you get in life - formal and informal - have a big impact on your life. He was really lucky that his dad was in the investment business. He was interested in numbers and read all the books on investment in the Omaha public library. He was not like Charlie in one way - if Charlie read about electricity, he wanted to learn everything Edison knew. But Buffett wanted to know whether it worked, not how it worked. He’s confessing here, not bragging. People ask, “If you could have lunch with someone living or dead…” and Charlie said he’s already had lunch with everyone - from the books he read.

Warren went to three different universities and attended high school in Washington, D.C. He found a few outstanding people and spent time with them. He mentioned that book that talked about 10,000 hours to get better at something. He said he could spend that much time on tap dancing and still not be that good - but if he spent 10 hours reading Benjamin Graham, he’d be much smarter. People have different talents. You are different from anyone else.

Benjamin Graham and David Dodd treated him like a son when he wanted to learn from them. Warren said, “I’d look around and see what fascinates you, and you’ll find the teachers.” A number of people like to help young people.

On the Department of the Government Efficiency (DOGE) and fiscal policy:

Bureaucracy can be difficult. Government doesn’t have checks on several things. That’s why it scares you - for example, about the future of currency. He thinks that how you control expenses in government is a problem that is never solved and it has dramatically affected many civilizations. But if you tell me how in a democracy we’re operating in a fiscal deficit over a long period of time - that something can’t go on forever and it will end - then we’re doing something that’s unsustainable. Paul Volker kept that from happening but we’ve come close. We’ve had substantial inflation but it hasn’t been runaway inflation. That’s not something you want to experiment with.

He said he wouldn’t want the job of correcting the gap between revenue and expenditures, currently at roughly 7%, when a 3% gap is more sustainable. The further away you get, the more uncontrollable things become. “It’s a job I don’t want - but it’s a job that has to be done - and Congress does not seem to be good at it.”

We have a capital stream and a brains-producing stream like never before, and if you don’t keep it going, things could go wrong. In theory, there should be downsides for someone who disrupts this machine - but there often seem to be upsides instead.

On economic principles of how Warren would have built the USA if it were 1776:

Warren said Benjamin Franklin had a great impact across almost all aspects of the country. He was so far ahead of his time. The best thing Warren could have done is get out of his way and let him keep thinking. He saw the problems in all fields. We do have a pretty good system in this country, but we won’t get far by lecturing others on how they should run their country. It’s a mistake to use persuasion as a lecture once you’ve already won the game. He would advise Franklin to win the game and keep humility at the same time. Try to reduce the things that could destroy the planet - there was no alternative to developing the atom bomb, but the expansion to 8 or 9 countries (probably including Iran) is concerning because it creates more things to worry about.

He said things are moving toward the ideals we've proclaimed. Generally speaking, we’ve moved in the right direction. He’d ask Ben Franklin about weapons of mass destruction and whether winners should have the ability to humiliate losers.

But he believes young people today can figure all of this out. It’s been amazing how many positive things have happened over the last 100 years. But the fundamental thing is that we have stability in society, trust in the government, and people operating in a way that aligns with the desire to succeed and get rich.

On Greg’s approach to managing subsidiaries:

Greg said he’s been learning since 2014. They've been sharing their business models, risks, and opportunities. His style is to ask questions and give comments about their businesses, but the subsidiaries remain autonomous. For example, if Geico goes through a tech transition, they need to make sure others are aware and the right people learn from it.

Warren said it will be better with Greg because he works harder. Some people need help when managing things, some don’t. In the early days, some managers would just quit if they got too many instructions. It's better when Greg says, “Here’s what you do and here’s what I would do.” It doesn’t work over time when the manager comes at them top-down. They don’t admire bosses who preach one thing but behave differently. If a boss behaves badly, it causes others to behave badly. If a manager does things to grease his own situation, pretty soon employees are giving their friends discounts under their accounts - and once it becomes contagious, it’s hard to stop. So you want someone at the top who is good. In a large company, you’ll get lots of behavior patterns, and Greg’s handled that better than Warren - who admits to being a bit lax about it.

On coal, Reuters report on dirty energy at Berkshire and transition to renewable energy:

Greg said that we should start with Iowa, as the report cited that as a significant problem. When Berkshire acquired Mid-American in 2000, there were two fronts: meet legal requirements, and implement public policies across the states. They entered into significant discussions with the Iowa governor about what they wanted in the state. It was predominantly coal at that time. They decided to stay balanced across different sources of energy. They built the largest wind project there. It had to be consistent with what the state wanted. They’ve deployed $16B in Iowa, in conjunction with governors, regulators, etc. They retired 5 of the 10 coal plants. But people would want to retire the other 5. They paid $16B to retire 5, but the reality is, they need the coal plants to keep the situation stable. They’ll ensure there are good balanced outcomes. Their Utility businesses will follow all federal standards.

On healthcare and why his project with Amazon and JP Morgan ended:

Warren said we’re spending close to 20% of GDP on healthcare. And if you went back to the 1960s, a number of countries spent around 5%. Then the lines (of spending) diverged dramatically. They tried the experiment with Amazon and JP Morgan. They had three people who didn’t know the answer. It was a tapeworm, and it was everywhere. Hospitals liked it. People liked to have their doctors and all kinds of things like that. Their project would not have helped with that 20% spending. They saw the degree to which the current system was ingrained in all aspects of healthcare. These people are trying to save lives - so it’s not a bad thing.

People come to the US to do difficult operations. Health is important, and the government is involved as well. He told Jeff Bezos and Jamie Dimon that the tapeworm (i.e. the current health system) won. The problem is that if 20% of GDP goes into one industry, the degree of enthusiasm to change that - with the political power they have - makes the change almost impossible. They didn’t know the answer to that.

He said the government is the only thing that could change it, but that’s hard to do, to get agreement within government. Our costs are so different from any country in the world. Through elected representatives, over time, we have developed a system that’s enormously different from any other country - I wish I had an answer for you. He was pessimistic when they went in, and he came out even more pessimistic. Trying to change things in government is difficult.

People make decisions they don’t like as they go along. They learn to rationalize it over time, but still, it’s worked so far. It’s easy to spend money and hard to cut people’s receipts. If you’re elected, you say you can do more good from there - but towards the end, you make concessions and compromises, and eventually, you change as a person. You can’t say the system is a failure, but it’s difficult to make major changes.

On whether it’s easier for a business operator to be an investor or vice versa:

Warren said it’s easier to sit in a room and play around with money. That has been a plus for him, and he doesn’t complain. He’s been able to choose his friends, which has made an enormous difference in his life. That’s a luxury. The five people he’s worked under have been great. He’s never been disappointed by any teacher he’s had. He’s been a business operator but wouldn’t like to compete on it because of the behaviors expected out of a business operator. The takeaway was that he’d rather be an investor than an operator.

Conclusion:

There were five minutes left in the meeting. Tomorrow there will be a board meeting. Two of his children, Susan and Howard, will know what he’ll be talking about. Warren said he thinks the time has arrived for Greg Abel to become CEO of Berkshire at year end. Let the board figure out any questions about meetings or structures around that. He believes the directors would be unanimously in favor of it. So, Greg would become CEO. Warren said he’d still hang around and be useful in a few cases. That means the final word would be with Greg Abel. He thinks the board would give Greg more authority on acquisitions and related matters.

Greg Abel didn’t know about it until Warren just announced it. In the next board meeting, they will digest the announcement and then decide whether to move forward and announce it to the public. Warren joked that he’ll play around with a Ouija board or something. He also said he doesn’t plan to sell a single share of Berkshire and that it will all be given away.

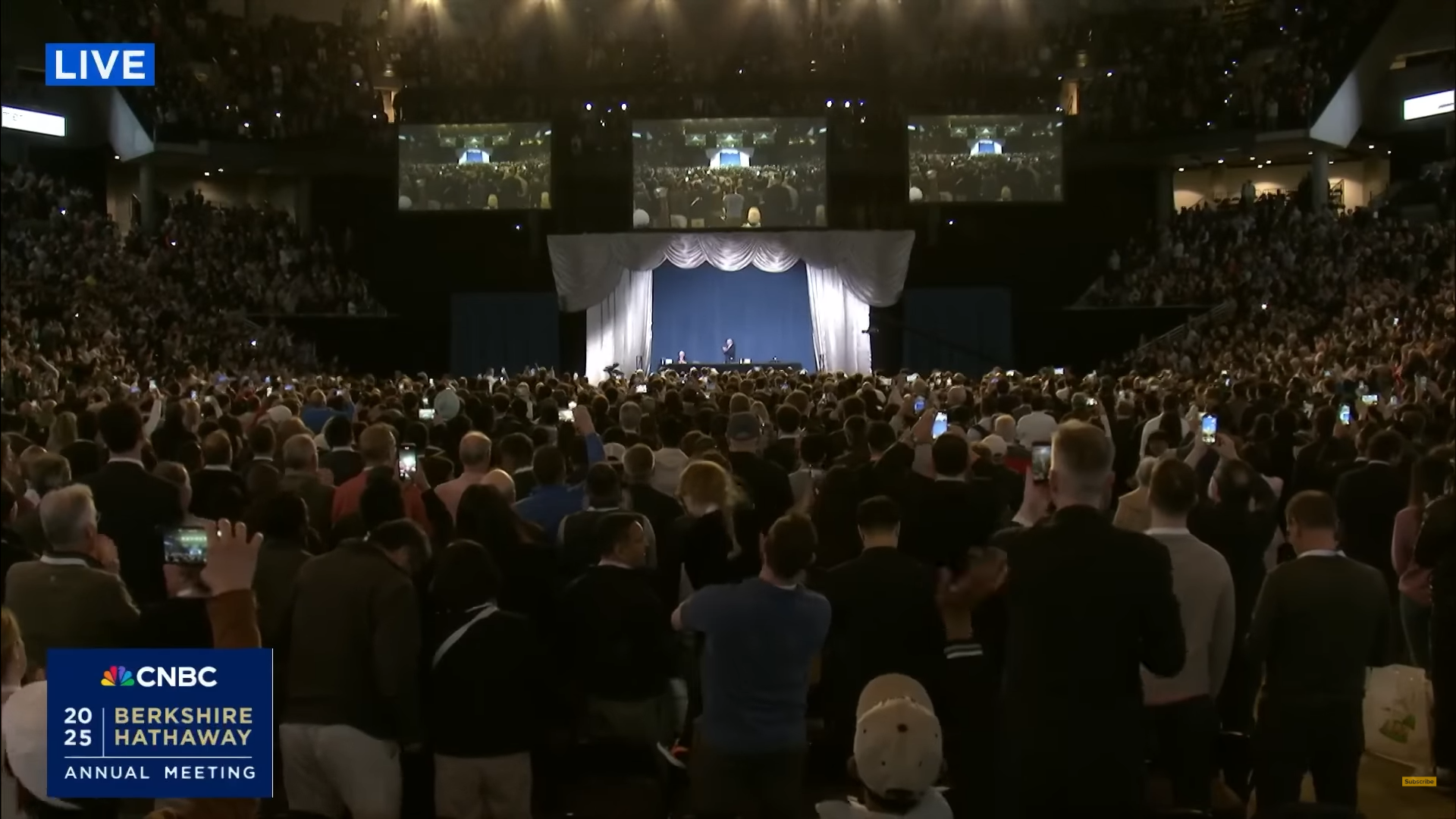

There was a standing ovation as pictured below.

Buffett looked visibly emotional as he signed off for the last time.

After the loud cheers, Warren Buffett joked, “The enthusiasm shown in that response can be interpreted in two ways, but I’ll take it as positive."

Follow me for more such content: Upendra Rajan

If you liked this article, you might also enjoy my notes from last year: here