Image 1. Warren Buffett, at 93 years

Image 1. Warren Buffett, at 93 years

The meeting began with an in-memoriam to Charlie Munger (1924–2023). Warren Buffett said Charlie had an inquisitive mind and cared about how everything worked. Charlie first became a director at Berkshire in 1979. Buffett calls him the architect of Berkshire.

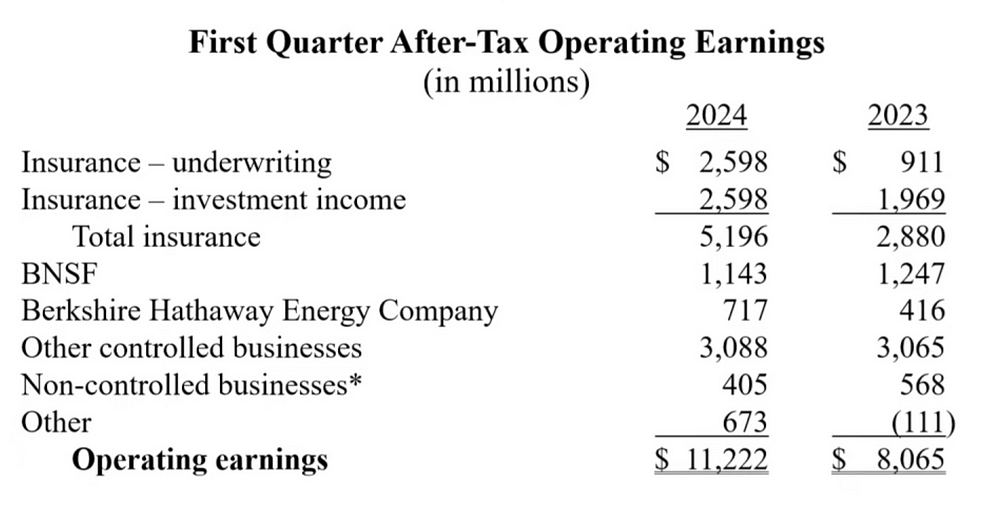

Buffett talked about the first quarter results.

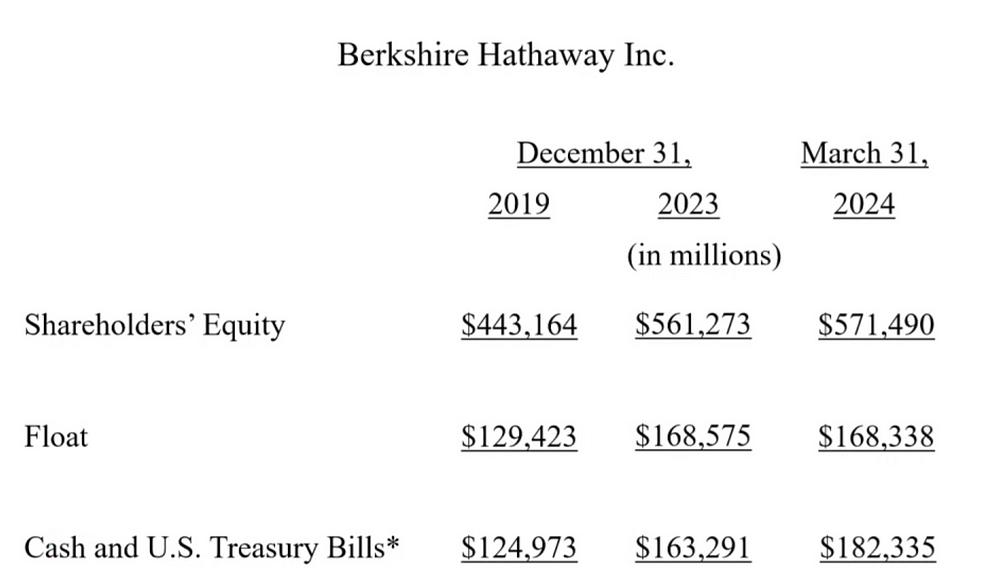

Buffett says the first quarter is not representative of the whole year for the insurance business. They are slightly down on railroad earnings. $11.2 billion is quite an improvement from last year. They are expecting earnings to go up modestly this year. The goal is to increase operating earnings each year. Shareholders’ equity has also gone up each year, as has the float (almost). Here’s a summary: The asterisk (*) below indicates that it does not include cash and US Treasury bills from railroads, utilities, and energy companies.

So, that’s the story of Berkshire — to increase earnings and decrease shares outstanding.

And then the questions started.

On selling 115 million Apple shares: Buffett says Apple will most likely be their biggest stake by the end of this year. In terms of deploying money, he looks at every stock as ownership of the whole business. According to Warren’s favorite book, “The Intelligent Investor,” the market is there to serve you and not instruct you. Buffett follows that principle to this day.

He said he doesn’t mind paying taxes and encourages all companies to do so. He thinks of it as the federal government owning a percentage of your business.

On whether he’d invest in Hong Kong and Chinese companies: Buffett says his primary investments will always be in the USA. American Express has a position in China. He has a position in BYD. His Japanese positions have been good and he sees himself holding those companies for a long time. But he doesn’t think he’ll make any direct investments, although it might be through these other companies. China has done incredibly well, but Buffett doesn’t see himself buying anything big outside of the USA.

On Berkshire Hathaway Energy’s decline and regulatory environment: Buffett says Utah has treated them/will treat them well by giving them rates they expect. He thinks private energy companies will be more efficient than public ones. And he thinks Berkshire is the best positioned private energy company.

Greg Abel says that the underlying demand, and costs of meeting that demand are incredible. They work with the states. For example, with Iowa, they made substantial investments and there were specific state regulations. With AI and data centers, the demand doubles. So, he wants proper recovery, or return on the capital invested. Regarding PacifiCorp, all the litigation will be challenged. It will take many years to resolve. He’s going to have to change how they operate those assets. People have worked hard to keep the power on during disasters. Now, they may have to work on things like “de-energizing” — i.e. turn off power during fires, for example. Fundamentally, he needs legislative and regulatory reform across the pacific west states. The gold standard has been Utah — the state caps non-economic damages on wildfire claims. And, they have created a wildfire fund that’ll facilitate liquidity to resolve the situation.

Buffett says the return on equity they have achieved on energy utilities changes from state to state. If you look at the ROEs of Apple or Coca Cola, it’s been impressive. But it hasn’t been great in electric utilities. And climate change will change that equation even more.

On generative AI: Buffett says he doesn’t know anything about AI. That doesn’t mean he denies its importance. It’ll be hard to get the genie back into the bottle. He draws an analogy with nuclear weapons. He saw something that made him nervous. He saw an image of him that didn’t come from him — so he thinks the potential for scamming people has increased now. It has potential for good and bad. So, he’d have to wait and see.

On Geico aging: Ajit Jain said Geico hasn’t been doing that great with data analytics — technology has been a bottleneck. By the end of 2025, he thinks Geico will be amongst the best.

Buffett says equating rates and risk is very important with insurance. But he thinks they’ve had good cost advantages. He doesn’t think it’s a threat to survival or even profitability. It’s been the best model in the industry and likes his position in the auto insurance business.

On who his trusted advisors are and what he values about them: Buffett says it depends on what they are advising about. He doesn’t ask his wife and sons what companies to buy. Charlie was his trusted advisor. To some extent, he talks to himself about investing. His children have become wiser — so he listens to them. He listens to his wife a lot — he won’t get into details. He’s always had trusted people around him, since his 20s, but there have been mistakes. Charlie hasn’t lied or even remotely misled to Warren even once. When you get those people in your life, cherish them.

Question to Ajit on climate change and insurance: The one thing that mitigates it in re-insurance is that they can reprice every year — i.e. they can get out of the business if they don’t like the price. Prices go up because of climate change. It’s difficult to say the exact extent. Regulators don’t make it any easier, making it harder to withdraw or change prices. So they don’t operate in some states. They’re looking for a decent return on capital. Everyone’s now making record profits. But that may not last for a long time.

Buffett says that climate change increases risks. It makes their business bigger over time. But, they do it one year at a time. And he likes having Ajit do this. You could have high IQs, but the insurance business is not just that. Ajit adds — climate change, like inflation, can be an advantage for the risk bearer. Buffett adds — they started at $7m and now they are a $40b company.

On Canadian companies, for example banks: Greg Abel says he has many operating businesses in Canada. He’s looking at making incremental investments there.

Buffett says there aren’t as many big companies in Canada as in the USA. If he sees something sizable, with interests in the USA, he’d have no hesitations investing in Canada. Canada could benefit from Berkshire too. Many years ago, a financial institution there had an issue. Ted Wesschler offered a solution — presumably by investing there. So, Buffett sees no mental blocks about investing there.

Question to Warren on Ajit Jain and future CEO: Buffett says he won’t find another Ajit Jain. He jokes that they’d have to worry about his health before worrying about Ajit. He says Ajit has created a well-functioning business since 1986, and it’s in a different class.

Ajit says he talks to them a lot and has a shortlist of candidates. He has identified a person to succeed him if something were to happen to him.

If you had one more day with Charlie, what would you do with him: Buffett says Charlie liked learning a wide variety of things. He was broader than Warren. They played golf and tennis together. They had more fun with things that failed. Then they had to really work their way out of them. Charlie never voluntarily exercised and never thought about what he ate — but still lived to 99.9 years old. With another day, they’d have done what they are doing today. Charlie said, “just tell me where I’ll die and I’ll never go there”. He’d never seen anyone who was peaking at 99. So, he doesn’t have a perfect answer but he’s covered all the ingredients of what’d go on in that one day. The question you should ask is who would you like to meet in your life and start meeting them. Don’t wait for the last day, and don’t bother with the others.

Armed conflicts and cyber-security insurance for utilities: Ajit Jain says it’s a fashionable product. It’s at least a $10 billion market. Profitability accounts for about 20% of the premium for the insurance bearers. Berkshire has been careful with it for two reasons — it’s difficult to know the quantum of loss and the aggregate potential of losses. Secondly, there is not enough data to understand the cost per loss. Each time you’re writing a cyber-security policy, it’s likely you’re losing money. It will be a big business, but there will be huge losses. So, they are staying away from it until they have more data.

Warren says when you insure, you should think about how much you can lose. If you’re the insurer, would you have one bad event or thousands of those disaster events? If one event can affect a thousand policies, then you’ve written a policy that could break your company. The agents like the commission. So, someone else would have to think about the aggregation of risk.

On Nevada (NVEnergy) wanting access to cheaper energy — why not invest in solar in Nevada where there’s sunshine, instead of fossils: Greg says solar is a good opportunity with NVEnergy, and they’ll continue to invest. The transition would take several years. In Nevada, in the next year, the last two coal units will retire. They’re replacing it with fossil fuels for now. In Iowa, 100% of their energy supply comes from wind. They need gas plants to fill in if solar or wind fails, so they’ll invest in that too in the foreseeable future.

Buffett asks about technological advancements. Greg says that rates and reliability matter. Buffett mentions that his friend Bill Gates knows a lot about it too. He adds that transitioning fully requires a lot of investments and a lot of smart people.

On higher costs of car and property insurance in Florida: Ajit says the Florida market has had a few tough years. There are two main problems: increasing lawyers and corruption, and the rising frequency and severity of storm activity, making it difficult to make money. Berkshire has increased exposure in Florida, subsidized by the rest of the country. Legislators are trying to improve the situation, and he’s hopeful it will change.

What advice do you want to share today that everyone should hear: Buffett says the American opportunity is limitless. You want to find the people to share it with and find the opportunities that will help you in life. Look back on your life from the future and figure out how to get there.

What’s changed for operating CEOs of companies within Berkshire: Buffett says overwhelmingly, the CEOs prefer to talk to Greg or Ajit. That’s understandable, as Buffett isn’t as efficient as before. But, it’s worked well for them. If you have 20 children, some will be go-getters and some won’t be. It’s similar for Berkshire. Buffett gets almost no calls from operating businesses. Business schools would have other thoughts, but that’s not how they operate in Berkshire.

Ajit says Warren handled the transition really well. After the transition, when Buffett got calls, he wouldn’t answer directly, but he’d make them feel good. People got the message and it’s not an issue today. Buffett says he can’t read as fast as before, and he’s not as efficient as before (he’s 94 now).

On India: Buffett says he’s sure there are lots of opportunities there. The question is whether they have any advantages there. He’s a little enthusiastic, and he’d like Berkshire’s management to pursue it. So, there may be an unexplored opportunity there. He’s not the one to do it, but it may happen in the future. Japan was great. India could be great. He says India could be great for Act II of Berkshire.

How will Berkshire cope with the loss of Warren and Charlie: Warren says Berkshire doesn’t need to attract people that often. Old age hits everyone eventually. It hits different people at different times. He has the problems solved unless something untoward happens but the directors have the competency to maintain their advantages over the years. He thinks they are in a good position.

Greg says they will attract the right people with an ownership mentality. And that won’t change.

A Malaysian shareholder says Warren’s a hero there. What has been your greatest learnings throughout, especially during the Covid-19 period: Warren thanks him. He also says that anyone who wants to retire at 65 will be disqualified from working as a Berkshire manager. He thinks Tom Murphy was the best business manager he’s known. If Warren had asked him to manage the textile business, it’d still have failed. A management consultant didn’t hire Tom Murphy. It’s a wonderful lesson in life to learn by watching a great person work. He acknowledges that this is not a great answer, but so far, it’s worked for him. At Berkshire, he’d like a big decision made every 20 years, but he’d want future managers to correct the decisions if they were wrong. He thinks Berkshire is in a great position.

On why not deploy more cash: Buffett says he will use it when they have a good opportunity. At current 5.4% rates, he doesn’t have to. There’s no such thing as needing to swing at every pitch. If he had $10m, he thinks he could deploy it quickly. But, it’s harder to find things at a bigger scale.

Thoughts on buying/selling homes in light of recent class action lawsuit: Greg says the industry will go through some transitions after that settlement. Real estate is an important purchase in life and Berkshire has a good set of agents.

Buffett says he has sold two houses so far. He didn’t negotiate down the commission. The system worked out very well. He’s been watching the system operate for several years now. He likes their home services agency group and he’s encouraged expansion in the real estate business. Greg says he bought a house abroad in Newcastle. It’s a different experience there. Agents in the USA do a lot of end-to-end work in the USA. It’s not the same in other parts of the world. It may be more affordable, but it may be a “you get what you pay for” situation.

Effects on Geico if Elon Musk’s autonomous driving goal becomes real: Buffett says in the extreme example of only 3 accidents in the USA in a year — it’s hard to do. If it really happens, data would show and prices would come down. GM used to be big in Insurance. When Uber started, they used a firm that’s now almost bankrupt because they didn’t do it right. Insurance looks easy at the start, then you realize you’ve done something stupid. If accidents reduce 50% it’s good for society but bad for insurance companies — but good for society is what Berkshire is looking for. The number of people killed has fallen by a lot over the years.

Ajit says because of technology, the number of accidents has come down. Cost of each accident has gone up. So, the total number hasn’t come down. Tesla is toying with that idea and so far it hasn’t been a success. Automation shifts expenses from insurance companies to the equipment provider.

On zero-emission vehicles: Buffett hopes massive adoption will happen. But Berkshire doesn’t have any additional talent in that space. He doesn’t know how to pick the winners in this industry. It’s been a moving target. Maybe governments aren’t good at solving it either. Climate change has been a problem. The USA causes the most problems but we’re asking poorer societies to change how they operate. That hasn’t been settled yet. When he was young, there were only 2 billion people. Now there are 8 billion. If you did a survey in the 1950s, people wouldn’t have guessed 8 billion as the current population. It’s a problem that’s hard to solve.

Carol Loomis is 95 years old and edits the annual report each year. Special ovation to her. Since 1977, she’s received a bracelet for each year. Buffett shared a story about Carol Lumis dating Ty Cobb. Carol never took an accounting course but became the best business writer in the USA. She just liked writing business stories and she started from scratch. In 1977, Buffett asked her to edit the annual letter. She’s done it till date.

Also, special mention to Ruth and David Gottesman who donated $1b to Einstein School of Medicine and waived all tuition fees.

Afternoon session:

Buffett says a significant number of Berkshire shareholders have contributed $100m or more to their local charities, usually anonymously. Buffett feels proud about that.

Question on whether Greg Abel will manage money: Buffett says the decision will be made by the board. If he were on that board, he’d let Greg Abel allocate capital. If you understand businesses, you understand common stocks. He thinks it’s the CEO’s responsibility to decide. At the sums Berkshire operates, it’d have to be strategically big. As the world gets more complicated, more could go wrong. You’d want to act when that happens.

Greg says the capital allocation culture currently at Berkshire will survive in the future.

On IT distribution businesses like TechData: Greg says they saw a good underlying value of that position. Their bid was topped by the highest bidder at that time.

Buffett said it’s a decent business. It was like selling jelly beans. You’re serving the purpose to a degree, but it isn’t your product in effect. You just have a good system of delivering it without tying up a lot of capital. With TTI, you had a marvelous person running things. Greg and Buffett went to Paul Andrews’ funeral. And everyone said something good. Buffett says if they can’t buy it at the price they want, they’ll find something else — just like they found TTI.

On similarities with markets in 1999: Buffett says there were years where he could have bought something by nightfall and there are times like now where he doesn’t see a lot of opportunities. When those opportunities come, Greg would know how to handle it.

On the thought process of exiting positions: Buffet says there are various reasons. One is if you need the money. One of the reasons Buffett and Charlie were successful was understanding customer behavior. He talked about his Apple buying decision and other department stores he’s bought over years — it was all about consumer behavior. Same story with See’s Candies. When they didn’t sell Apple phones, people went to Best Buy. He says psychologists call it apperceptive mass. He knows that when he experiences it. If people had an iPhone and a second car that cost them over $30K — and if you told them they have to give up one thing — they would give up the car. He knows what it means to people. It’s one of the greatest products ever. Tim Cook is the equivalent to a partner — partner to Steve Jobs. He knows how to do it well. Buffett saw the same with Geico. Lorimer Davidson on a Saturday over 4 hours taught him everything about insurance. All these people in this room, and you decide this one person should be your spouse. It’s the same concept. You have to have a whole lot of experiences and then see that one thing when the lightbulb goes off.

Greg nudges Buffett about Occidental Petroleum. Buffett said he knew a lot about Oil and Gas. But he’d never heard of Vicki until they met over a weekend and made the deal. It wasn’t a cinch that it was a good decision. They have the option to buy more shares. He wants to own it long term.

Buffett adds that selling Paramount was all Buffett’s decision. They lost money on it. It was all his decision and not Ted or Todd’s.

On BNSF’s problems: Greg says that this quarter’s results were disappointing if you compared it with other railroads. In 2021, there were supply chain issues. In 2023, “cost structure” wasn’t adjusted relative to demand. Overall demand will be flat over the years. So, they’ll have to adjust their operational costs.

Buffett says owning railroads has worked out really well for him. It’s essential for the country. They only had the opportunity to buy BNSF. He just hopes he can find something similar in other industries.

On how Buffett would invest a small sum: Buffett says his method would be to go through the 20,000 pages of Moody’s manual to find interesting businesses. Some time ago, there were hundreds of railroad companies and Buffett read through every one of them. At one point, Buffett knew about the Los Angeles Athletic Club when Charlie thought he was the only one who knew about it. He recommends finding the equivalent of Moody’s. Be interested in the subject rather than being just interested in the money.

Buffett mentioned that the directors need to think for themselves rather than bow to conventional wisdom.

Charlie knew the importance of human behavior and psychology. He gave talks on biases. After explaining it, he believed it was beneath him to use the methods to go one-up on someone. Buffett encouraged people to read Poor Charlie’s Almanack.

On picking the right heroes in life: Buffett said his younger sister was there today. It’s important to have someone with the right values. His dad was. He ran away from home with his friends once to Hershey, Pennsylvania. The state police picked them up. They ended up back in Washington, D.C eventually. One of his friends who’d run away with him — his mom ended up in the hospital. Buffett’s dad said “I know you can do better.” His dad was his hero. So, pick the people who you want to be. His sister Bertie once ran away too, but it was just a few miles away to their grandparents’ house. He implied she wasn’t even good at running away.

On Pilot: Buffett says a couple of directors had doubts about that deal. But he says Pilot is working well for Berkshire. His friend once told him, “All’s well that ends.” Buffett says there’s a podcast about Pilot and recommends everyone listen to it.

Greg says Pilot will serve any fuel customers want. The point is they have exceptional locations — hundreds of them.

On compounding quality and being physically healthy: Buffett says you have to be lucky. He was lucky he didn’t get into a bad accident. When he was younger, he wouldn’t have thought he’d make it to 90. Buffett also talked about equal opportunities for women.

On S&P 500 index’s weighting and Buffett asking his wife to invest in the index in his will: Buffett says he revises his will every few years. He has left his wife more than she’d need. She doesn’t need to worry about whether she beats the S&P 500 or not. It’s not an economic condition with the rest of his family as well. He shared a story about Paul Getty (who was the richest man in the world in the 1950s) and his will, and all the codicils he’d leave in it. He said humans all have weaknesses — don’t be so hard on yourself but don’t be so forgiving.

What part of Berkshire is most at risk with AI: Buffett says anything that’s labor intensive. There will be more leisure time. Some people like having more problems to solve in leisure time. In terms of businesses, Buffett is confident they will figure it out. Keynes wrote a book about what could happen in a hundred years — predicted output per capita would grow incredibly and turned out to be mostly right. But he couldn’t predict it exactly right. Buffett recommends everyone read the Einstein-Szilard Letter, which started the Manhattan project.

On national debt ballooning: Buffett says the US debt would be acceptable for a long time because there’s no alternative. He credits Paul Volcker who acted during the crisis to control the situation. He thinks Jay Powell is very wise — he sends out pleas on where to pay attention.

On work-life balance and if he has any regrets: Buffett says he can think of all kinds of things that could have been done differently. But he doesn’t like too much self criticism. Who knows one tradeoff is better than another. There’s no point in beating yourself up about the past. Try to do things important to you. Buffett likes the feeling of being trusted. Charlie did too. He won’t be looking to change much. If he’s lucky, he gets another 6–7 years to live. Find what you’re good at (what you enjoy), be kind and the world’s better off.

Ethical bequest to Berkshire shareholders: Buffett asks shareholders to read Poor Charlie’s Almanack because Charlie has expressed it well.

He hopes everyone will come to next year’s meeting, and he hopes he can make it as well.Follow me for more such content: Upendra Rajan

If you liked this article, you might like my last year’s meeting notes: here